Irs Write Off Gambling Losses

- Irs Write Off Gambling Losses Against

- Irs Write Off Gambling Losses Rules

- Irs Write Off Gambling Losses Offset

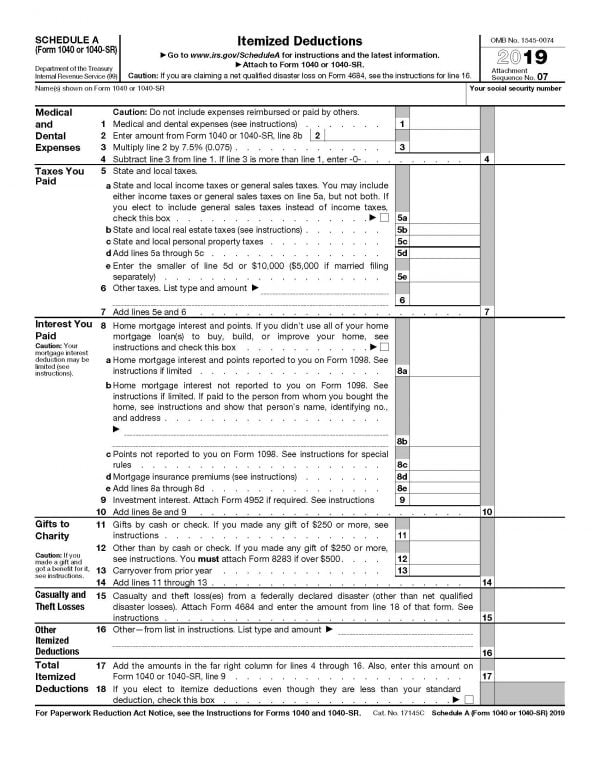

Gambling Losses You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040 or 1040-SR) PDF and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Gamblers can't deduct losses if they use the standard deduction. Gamblers can deduct losses only if they itemize on Schedule A of Form 1040. Year in and year out, gamblers get tripped up by this limitation. Gambling losses are considered miscellaneous deductions that are claimed at the bottom of Schedule A. Unlike US residents, non-resident aliens cannot deduct gambling losses from their tax bill. However, a tax treaty between the US and Canada allows Canadian citizens to deduct gambling losses up to the amount of their gambling winnings. Can I Write Off My Gambling Losses On My Tax Return? Yes, you can write off gambling losses on a tax return.

We doubt that anyone ever woke up thinking, “Gee, I hope I get audited by the IRS this year”. An IRS audit could easily be one of the worst things that could happen to you this year. So if you want to avoid receiving that ominous letter from the IRS that your 2015 tax return is being audited here are seven red flags you need to totally avoid.

Not reporting all of your taxable income

Those 1099’s and W-2s you received this past January? You weren’t the only one that got them. The IRS got them too. It’s important to make sure you report all of the required income on your return. The computers used by the IRS are pretty darn good at matching the numbers on your return with the numbers on your 1099s and W-2s. If they turn up a mismatch this will create a red flag and the IRS computers will spit out a bill. If those darn computers do make a mistake and you receive a tax form that shows income that wasn’t yours or lists incorrect amounts of income, you will need to get the issuer to file the correct form with the IRS. And what about that income you earned on those side jobs? In most cases you should have received a 1099 documenting your earnings. If not, this is definitely a case where it’s better to be safe than sorry and report it.

Taking deductions that are higher than average

If the IRS spots deductions on your return that are disproportionately large in comparison with your income, it may pull your return for review. For example, a very large medical expense –again out of proportion to your income – could cause a red flag. However, if you do have the documentation to support the deduction then don’t be afraid to claim it.

Claiming really big charitable deductions

Charitable deductions can be a great write off. Plus, when you contribute to a charity it can make you feel all fuzzy and warm inside. However, if those deductions are disproportionately large in comparison with your income, it will raise a red flag. The reason for this is because the IRS knows what is the average charitable deduction for people at your level of income. Did you donate some very valuable property? In this case we hope you got an appraisal for it. Did you make a non-cash donation over $500? Then you better make sure you file form 8283. if you don’t file this form or if you don’t have an appraisal supporting that big donation you’ll become an even bigger target for auditing.

Claiming big gambling losses or not reporting gambling winnings

If you’re a recreational gambler you must report your winnings as “other income” on the front page of your 1040 form. If you’re a professional gambler you will need to report your winnings on Schedule C. If you don’t report gambling winnings this can draw the attention of the IRS – especially in the event that the casino or other venue reported your winnings on form W-2G. It can also be very risky to claim big gambling losses. In fact, what you should do is deduct your losses only to the extent that you report your gambling winnings. For example, if you were to report you had won $5000 gambling but had losses of $20,000, this could cause a red flag. Also, only professional gamblers can write off the costs of meals, lodging and other expenses related to gambling. And the surest way to invite an audit is by writing off what you lost at gambling but no gambling income. If you’ve done any of these things, or are worried about some other common tax return mistakes, it might be wise to file an amended tax return and account for those wins or losses correctly.

Irs Write Off Gambling Losses Against

Writing off a hobby as a loss

You will dramatically increase the odds of “winning” an IRS audit if you file a schedule C showing big losses from any activity that could be considered a hobby such as jewelry making, coin and stamp collecting, dog breeding, and the like. IRS agents are especially trained to ferret out people who improperly deduct losses associated with a hobby. You must report any income your hobby generated or whatever but can then deduct your expenses up to that income level. But the IRS will not allow you to write off losses from a hobby. So if you want to write off a loss you must be running your hobby as if it were a business and must have the reasonable expectation of generating a profit. As an example of how this works if your hobby generates a profit in 3 out of every 5 years then the IRS will presume that you’re actually in business to make a profit unless it can prove something to the contrary. Of course, if you’re unfortunate and win the audit lottery the IRS will make you prove that you do have a legitimate business and that it’s not just a hobby. So make sure you keep all documents that support your expenses.

If you report income from self-employment of $100,000 or more

Let’s suppose that you’re self-employed, had a really great year and had earnings of $100,000 or more you are reporting on schedule C. This is likely to trigger an IRS audit because according to the IRS people who file a schedule C are more likely to under report their income and overstate their deductions. What this means is that if you earn $100,000 or more and are reporting it on schedule C you’ll need to make sure you have the documentation necessary to support your deductions and again, make sure you report all your income very accurately.

If you work in certain industries

The IRS knows based on past audit experience that there are certain activities or industries that have a higher incidence of what’s technically called noncompliance but really means cheating on their taxes. Included in this group are the tax returns of air service operators, gas retailers, auto dealers, attorneys and taxi operators. So, if you’re employed in one of these industries or activities and don’t want to suffer an IRS audit, it’s best to follow the old adage that honesty is the best policy.

Did you have gambling losses last year? If so, you may be entitled to a deduction. Here is what you need to know at tax return time.

The most important rule

The biggest single thing to know is that you can only deduct gambling losses for the year to the extent of your gambling winnings for the year. So if you won $2,500 gambling in 2014, the most you can deduct of your losses is $2,500 — no matter how much you lost. This limitation applies to the combined results from any and all types of gambling — playing the lottery, slots, poker, the horses, and all the rest. And the limitation applies to both amateur and professional gamblers.

After applying the losses-cannot-exceed-winnings limitation, the allowable gambling loss deduction for a person who is not a professional gambler is claimed on Line 28 of Schedule A (Itemized Deductions). If you don’t itemize, you get no write-off. Also, amateur gamblers can only deduct actual wagering losses. Other gambling-related expenses (transportation, meals, lodging, and so forth) cannot be written off.

An amateur gambler should report the full amount of his or her winnings as miscellaneous income on Line 21 on Page 1 of Form 1040. If your winnings exceed your losses, you cannot just report the net winnings on Line 21. Instead, report your gross winnings on Line 21 and your losses (up to the amount of your winnings) on Line 28 of Schedule A, assuming you itemize.

Over the years, quite a few court decisions have attempted to define what it takes to be a professional gambler. The bottom line is you must devote substantial time to gambling on a regular basis, and you must depend on gambling winnings as a meaningful source of income.

It also helps if you conduct your gambling activities in a businesslike fashion by keeping detailed records of wins and losses and developing and evaluating strategies.

If you can rightly claim professional gambler status, report your gross winnings as income on Line 1 of Schedule C of Form 1040 (Profit or Loss from Business). Report your losses (up to the amount of your winnings) and your allowable out-of-pocket gambling-related expenses (for transportation, 50% of out-of-town meal costs, out-of-town lodging, and so forth) as business expenses on Schedule C.

Note that a professional gambler’s allowable out-of-pocket expenses can be deducted in full on Schedule C without regard to the amount of winnings. In other words, you aren’t required to combine out-of-pocket expenses with gambling losses in applying the losses-cannot-exceed-winnings limitation.

Warning: The seemingly benign rule that a professional gambler’s winnings and losses belong on Schedule C can have a big negative impact in profitable years, because net Schedule C income gets hit with the dreaded self-employment tax. In some cases, this can make claiming professional gambler status more expensive than amateur status.

Form W-2G keeps winners honest

For most types of gambling at a legitimate gaming facility, you will usually be issued a Form W-2G (Certain Gambling Winnings) if you win $600 or more. The IRS gets a copy too, so you better make sure the gross gambling winnings reported on Line 21 of your Form 1040 (or on Line 1 of Schedule C if you are a professional) at least equal the sum of the amounts reported on any Forms W-2G you receive.

Record keeping basics

Whether you are an amateur or professional gambler, you must adequately document the amount of your losses in order to claim your rightful gambling loss deductions. According to the IRS, taxpayers must compile the following information in a log or similar record.

- The date and type of each wager or wagering activity.

- The name and location of the gambling establishment.

- The names of other persons (if any) present with you at the gambling establishment (obviously this requirement cannot be met at a public venue such as a casino or racetrack).

- The amount won or lost.

You can document winnings and losses from table games by recording the number of the table and keeping statements showing casino credit issued to you. See also IRS Publication 529 (Miscellaneous Deductions) at irs.gov.

Per-session record keeping is apparently OK

In theory, you are supposed to record each gambling win or loss — from each spin of the slot machine, each poker hand, and each horse race. Of course, nobody actually does that. Thankfully, the IRS relented a few years ago by saying that casual slot players can simply keep a record of the net win or net loss amount for each gambling session. The Tax Court appeared to endorse this per-session approach in a 2009 decision. The casual slot player should then report the sum total of net winnings from all winning sessions as income on Line 21 of Form 1040 (the amount should at least equal the total amount of winnings reported on any Forms W-2G you receive). The sum total of net losses from all losing sessions can be deducted on Line 28 of Schedule A, subject to the losses-cannot-exceed-winnings limitation. Presumably, the per-session approach of recording net wins and losses from each gambling session will also be considered adequate record keeping for other types of gambling for both amateur and professional gamblers. Poker players, take note!

2016 MarketWatch, Inc. All rights reserved.

Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. Intraday data delayed per exchange requirements. SP/Dow Jones Indices (SM) from Dow Jones Company, Inc. All quotes are in local exchange time. Real time last sale data provided by NASDAQ. More information on NASDAQ traded symbols and their current financial status. Intraday data delayed 15 minutes for Nasdaq, and 20 minutes for other exchanges. SP/Dow Jones Indices (SM) from Dow Jones Company, Inc. SEHK intraday data is provided by SIX Financial Information and is at least 60-minutes delayed. All quotes are in local exchange time.

Stocks

Columns

Authors

Topics

No results found