Does Using Gambling Sites Affect Your Credit Rating

The first is that betting will not have any impact on your credit rating, it is accepted that many people place bets for enjoyment. However, the second factor is key, and that is that if you show signs of being an irresponsible gambler, even if you don’t consider yourself to be one, then this could have an effect on your credit rating. That’s good news, because having those derogatory marks on your reports can lower your credit scores. Other derogatory marks that may affect your credit include accounts in collections, bankruptcies and foreclosures. Medium impact credit score factors Age of credit history. This factor shows how long you’ve been managing credit. The effect of an overdraft on your Credit Score. Dipping into your overdraft now and again – basically using it as intended – shouldn’t have a significant impact on your Credit Rating. In fact, showing that you can successfully manage and repay a short-term form of credit may even be a positive factor in the minds of future lenders.

- Does Using Gambling Sites Affect Your Credit Rating Credit

- Does Using Gambling Sites Affect Your Credit Rating Check

Do I have only one credit score?

You don't have just one credit score, or just one credit report. As well as the three UK credit reference agencies (including Experian), lenders have their own ways of calculating your credit score.

Each company may consider different information when working out your score, depending on their criteria and what data they have access to. They may also differ in how they see your information – for example, a certain record on your report could look negative to some companies, and positive to others, depending on what they’re looking for in a customer. So, your score will probably vary between the different credit reference agencies and companies.

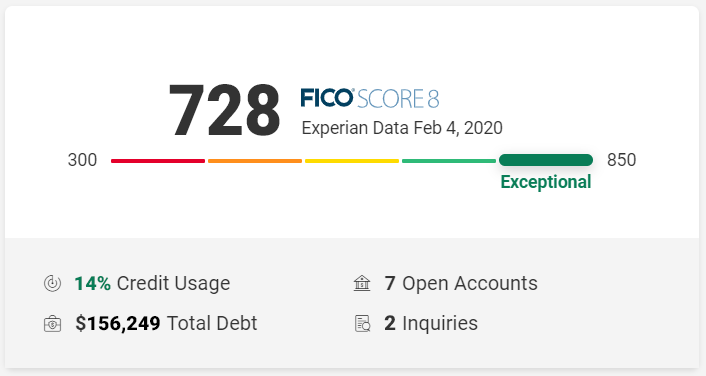

The Experian Credit Score is completely free and gives you an indication of how companies may see you. It’s represented as a number from 0-999, where 999 is the best possible score, and is based on the information in your Experian Credit Report. You can check it without paying a penny, and it’ll be updated every 30 days if you log in.

What’s good for your credit score?

While there isn’t just one score, there are some general rules about what could affect your score and what won’t.

Does Using Gambling Sites Affect Your Credit Rating Credit

A good credit score generally comes from a history of managing money responsibly. This doesn’t mean you shouldn’t borrow money though – in fact, companies often like to see a track record of timely payments and sensible borrowing.

Whether you’re working to improve a poor credit score or need to build up credit history from nothing, here are a few basic rules:

- Only borrow what you can afford. If you want to use credit, make sure you can at least meet the minimum repayments comfortably.

- Consider setting up direct debits. Regular payments look good to companies, so consider setting up direct debits for things like a mobile phone contract or credit card, to ensure you meet your payments on time and in full.

- Pay off credit if you can. It looks good if you owe less than the amount you’re allowed to borrow.

- Try to keep old, well-managed accounts. Credit scoring looks at the average age of your bank accounts, so try not to chop and change too much.

- Register to vote at your current address. Companies use the electoral register to help confirm who you are and where you live. You can register even if you’re living with parents or sharing student accommodation.

- Check your credit report regularly for accuracy. You don’t want inaccurate negative factors affecting your score, so if you do find anything that needs correcting, contact the relevant company – we can also raise a dispute on your behalf.

- Help protect yourself and your credit score. Look out for unfamiliar or suspicious entries in your credit report, as these could mean you’ve been a victim of fraud or identity theft. You can check your report anytime and receive alerts for certain changes to your report with a CreditExpert paid subscription. Note that if you do become a victim of fraud, your company should correct any damage to your report and score quickly.

What’s bad for your credit score?

When companies check your credit history, they may see some kinds of financial behaviour as a red flag. If possible, you should avoid or minimise these to keep your score as high as possible:

- Frequently setting up new accounts. Opening a new bank account should only lower your credit score temporarily – but if you do it too often, your score won’t have time to recover.

- Being at your credit limit. Try not to max out your credit card or use your entire overdraft, as lenders may think you’re in financial difficulty.

- Applying for credit too often. Each application negatively impacts your score, even if you’re not approved. This is because each application records a hard search on your report. Try to only apply for credit you’re eligible for.

- Missing payments. If you miss regular payments to lenders they may record a default on your report. This can lower your credit score for up to six years.

- Borrowing more than you can afford. If you can’t pay off your debts, you may have to get a Debt Relief Order or Individual Voluntary Agreement. Lenders can also try to reclaim money you owe by getting a County Court Judgment issued against you, or by applying to make you bankrupt. Any of these will reduce your credit score and make it difficult to borrow money or even open a bank account.

What doesn’t affect your credit score?

Typically, there are lots of myths and falsehoods swirling around about what affects your credit score and what doesn’t. Here’s a list of common misconceptions – things that don’t have any impact on your credit score:

- Previous occupants at your home address. It makes no difference if the previous occupant at your address was bankrupt or a billionaire. Companies are only interested in your financial details and anyone you’re linked to financially, such as a joint bank account.

- Friends and family you live with. As mentioned above, companies are only interested in people you’re financially linked to – and living in the same house with someone isn’t a financial link unless you share finances, such as a joint mortgage, with them (sharing the rent doesn’t count).

- Things from your distant credit history. Most of the information in your credit report is held for around six years, and companies often focus on more recent information. So, missing a credit card payment a decade ago won’t affect your current credit score.

- Checking your credit score or credit report. You can check your own credit score and credit report as many times as you like and it will never have any impact on your score.

- Comparing credit offers with Experian. By searching for things like a credit card or loan, you’re not actually applying for them but simply asking for a quote. This is called a soft check and doesn’t leave a record on your credit report or affect your credit score.

It’s worth noting that your Experian Credit Score won’t be affected by things like your income, savings, employment, or health expenses, because this information isn’t recorded on your credit report. However, companies may ask questions about these factors when you apply for credit, and may use these details when calculating their own version of your score.

Does Using Gambling Sites Affect Your Credit Rating Check

There is a way you could raise your score instantly with the help of Experian Boost. By securely connecting your current account to your Experian account, you can show us how well you manage your money. We’ll look for examples of your responsible financial behaviour, such as paying your Netflix, Spotify and Council Tax on time, and paying into savings or investment accounts.

Get your Credit Score with Experian